child tax credit 2021 october

October 14 2021 726 AM MoneyWatch. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

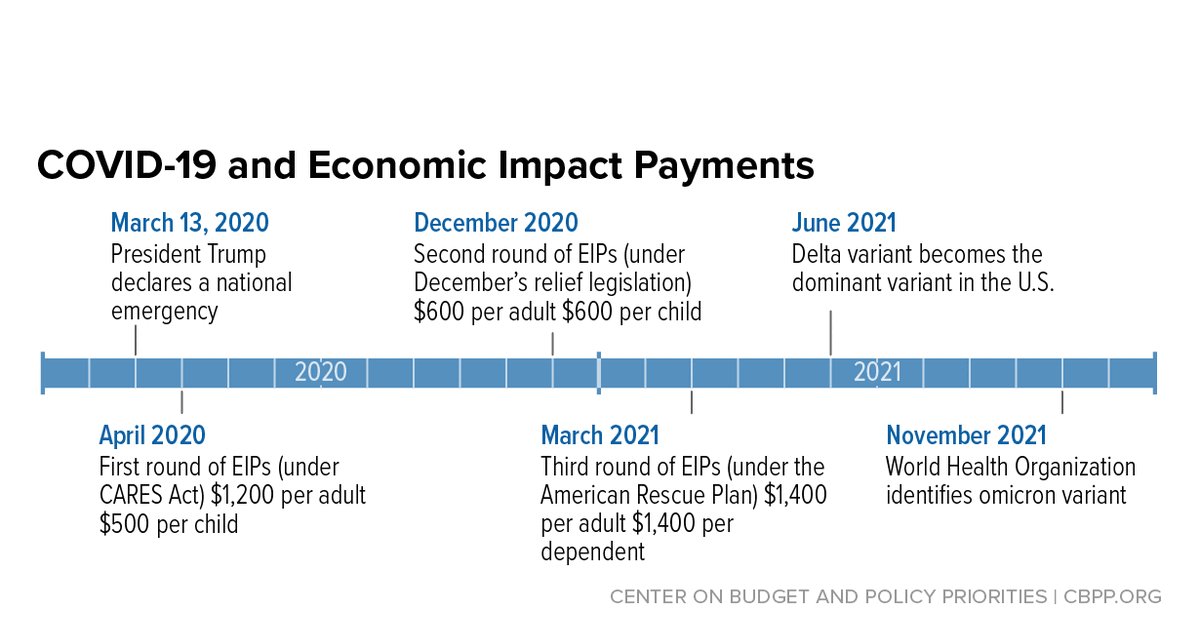

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

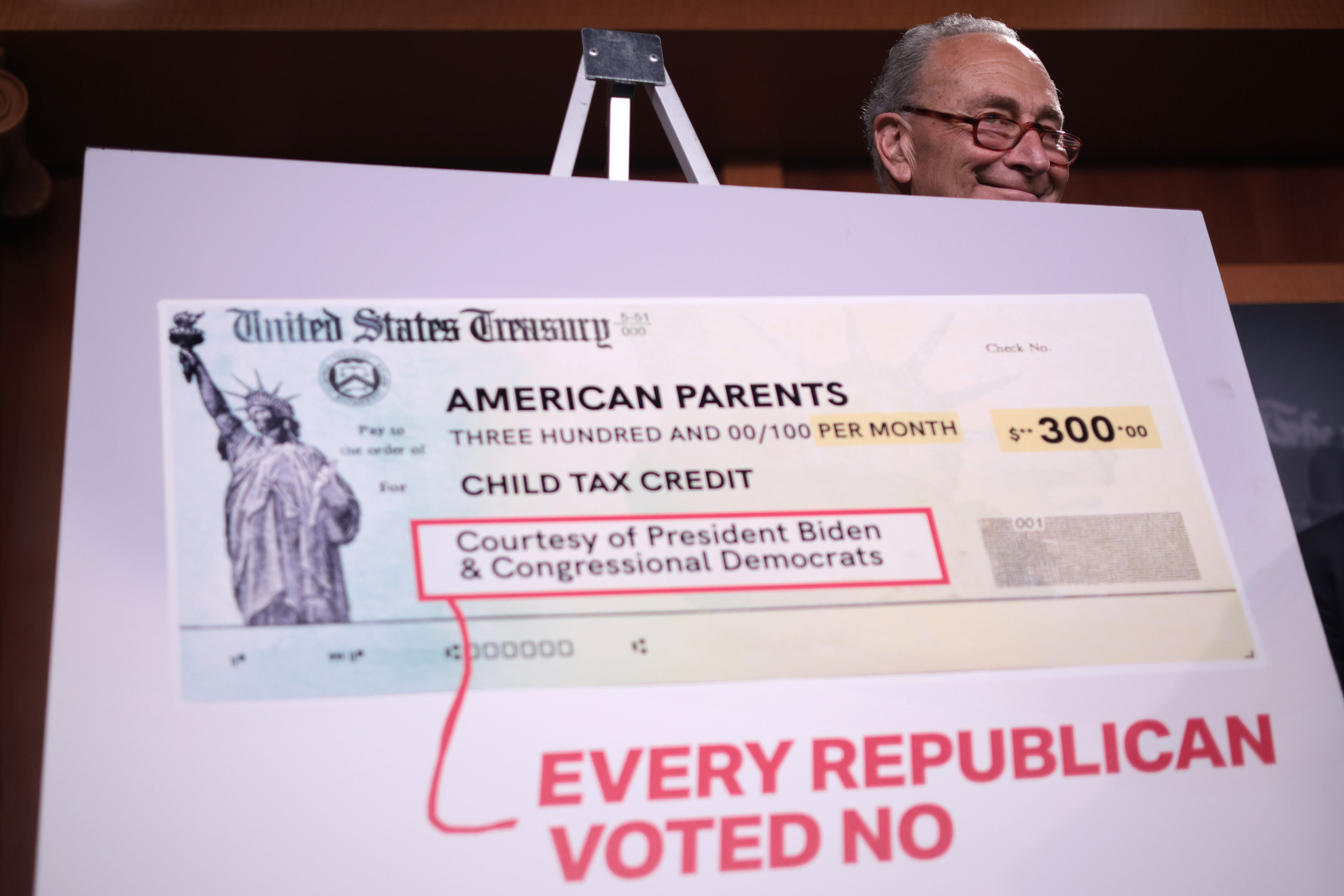

The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of age.

. Changes in income filing status the birth or death of a child or having a child move into or out of your household may have affected the amount that you are eligible to receive when you file your 2021 tax. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. 2021 Child Tax Credit Calculator.

Home of the Free Federal Tax Return. By Aimee Picchi. When you file your 2021 Taxes you will need to reconcile any advance Child Tax Payments you received during 2021.

The deadline to e-file 2021 Tax Returns was October 17 2022. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

152 PM EDT October 15 2021. Small children with face mask back at school after covid-19 quarantine and lockdown writing. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6.

Instead use these 2021 Tax Calculators and Forms to prepare your 2021 Taxes before you mail them to the IRS andor state tax agency. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

The Advance Child Tax Credit. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail on Friday. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Use the Child and Dependent Care Calculator - or CAREucator - tool below to see if you qualify for the Child and Dependent Care Credit. That means another payment is coming in about a week on Oct.

Around 36 million eligible American families will receive financial relief as part of the Child Tax Credit. As part of the continuing process of building out the advance CTC program which has included outreach to bring in previous non-filers and the launch of the CTC Update Portal that has allowed millions of. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6. See what makes us different.

But the income. October 14 2021 459 PM CBS Chicago. The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty researchers pointing to the.

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

The phaseout range for the basic 2000 child tax credit for 2021 starts at a modified adjusted gross income of 400000 for married filing jointly and 200000 for other filers. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. E-File Directly to the IRS.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail on Friday. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. IR-2021-201 October 15 2021.

The IRS will soon allow claimants to adjust their income and custodial. These payments are. As of October 17 2022 you can no longer prepare and eFile 2021 Tax Returns.

The Child Tax Credit has been expanded from 2000 per child annually up to as much as. But many parents want to know when. The IRS will soon allow claimants to adjust their income and custodial.

Use these 2021 Tax Calculators and Forms to help you prepare your 2021 Taxes before you mail them to the IRS andor State Tax Agency. The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what the monthly poverty rate in October would have been in its absence. 152 PM EDT October 15 2021.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. We dont make judgments or prescribe specific policies. Elaine Maag of the Urban-Brookings Tax Policy Center.

That depends on your household income and family size. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Expiration Of Child Tax Credits Hits Home Pbs Newshour

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Did Your Advance Child Tax Credit Payment End Or Change Tas

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit In 2022 Is Your State Sending 750 To Parents Find Out Now Cnet

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Tds Due Dates October 2020 Dating Due Date Income Tax Return

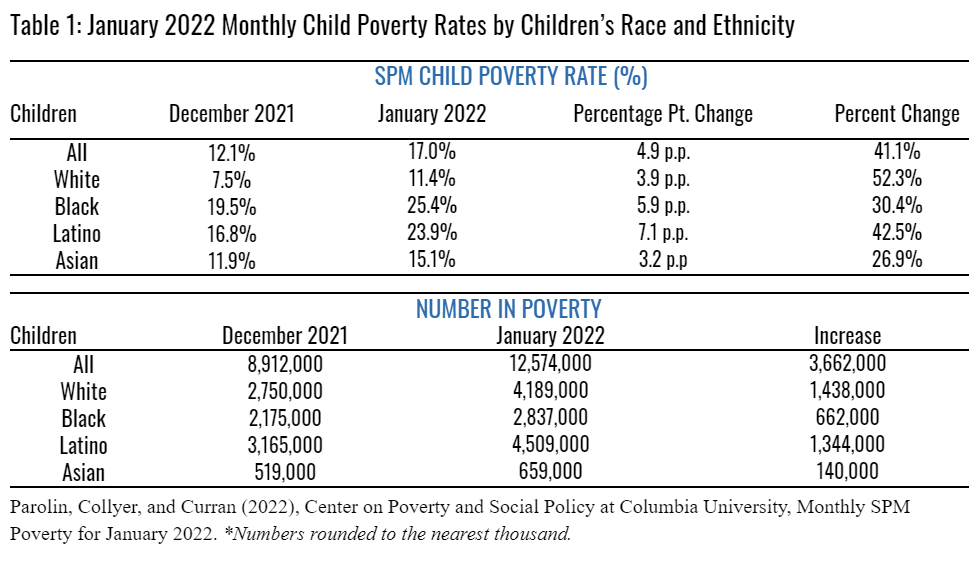

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Still Need To Do Your Taxes Here S A List Of Items Most Taxpayers Need To File Their Tax Return Taxes Taxpreparation Tax Refund Tax Preparation Tax Return

Tax Excellence Team Salary Taxation Workshop Call Now For Enroll Today 02134329107 To 109 03343223163 Duamark Network Marketing Web Marketing Social Marketing

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back